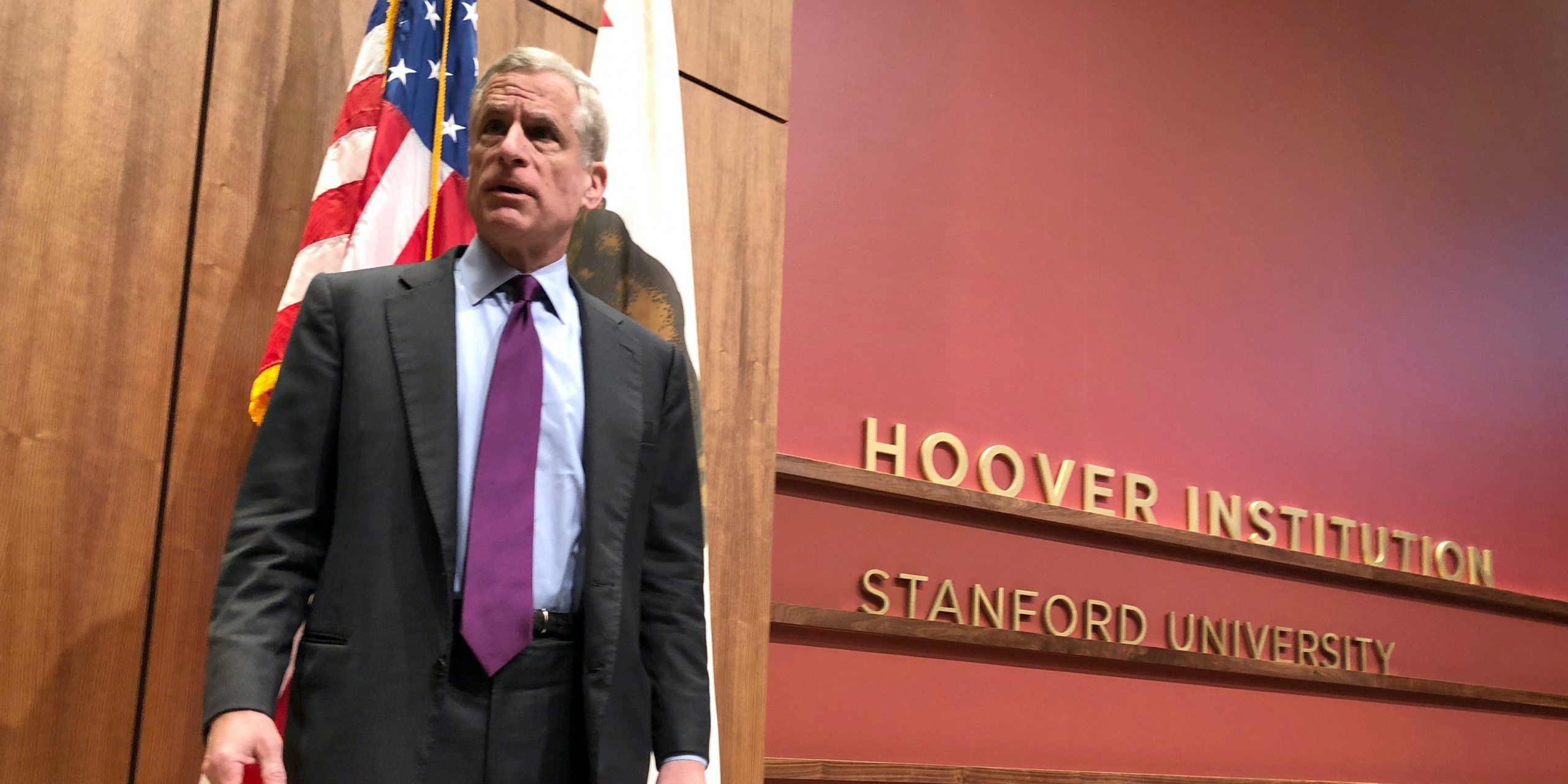

- A nationwide mask-wearing mandate would slow the coronavirus’ spread and boost the US economic recovery, Robert Kaplan, president of the Federal Reserve Bank of Dallas, said Friday.

- Additional monetary and fiscal stimulus is important, but adhering to public health protocols is “the primary economic policy” for helping the US grow faster, Kaplan said on Fox Business.

- The Fed president’s remarks arrive as COVID cases spike throughout the US and raise fears of a halted economic bounce-back.

- Goldman Sachs analysts previously estimated a mask mandate would cut the daily growth rate of infections to 0.6% from 1.6% and spare the US from a 5% hit to gross domestic product.

- Visit the Business Insider homepage for more stories.

Wearing masks and slowing the coronavirus’ spread is critical to helping the economy grow faster, Robert Kaplan, president of the Federal Reserve Bank of Dallas, said Friday.

Surging coronavirus case counts across the US have revived concerns of a second economic downturn just as data releases point to a rapid recovery through the end of spring. California, Texas, and Florida have seen numerous record-high readings in infections and COVID-related hospitalizations over recent weeks, prompting governors to retract some reopening measures. Economists now expect the steady hiring and spending trends seen in May to slow as lockdowns are reinstated.

The White House has strayed from implementing a mask-wearing mandate despite the new outbreaks. Yet adopting widespread mask usage could be the silver bullet to keeping the economic recovery on track, Kaplan said.

“While monetary and fiscal policy have a key role to play, the primary economic policy from here is broad mask-wearing and good execution of these healthcare protocols,” Kaplan said on Fox Business. “If we do that well, we’ll grow faster.”

A mask-wearing policy would ultimately push the unemployment rate lower and better the odds of near-term reopenings taking place, he added.

The central bank chief's comments arrive after analysts at Goldman Sachs argued a mask mandate would accelerate the economic bounce-back. Such a law would increase the number of mask wearers by 15 percentage points and slash the daily growth rate of confirmed COVID-19 cases to 0.6% from 1.6%. All in all, the nation could dodge a 5% decline in gross domestic product if the executive branch implemented a mask order, the team led by Jan Hatzius said.

Kaplan sees the national economy severely contracting even after posting strong growth through the second half of the year. Containing the coronavirus is the key factor in deciding whether the economic recovery will taper off or continue at its current pace into 2021, he said.

"My base case for the year still is we'll wind up contracting in the United States by about 4.5 to 5%, but how the virus proceeds and what the incidence is, is going to be directly related to how we grow. But we'll grow," Kaplan said. "It's just a question of, with this resurgence, is that going to slow the rate of growth from here."

Now read more markets coverage from Markets Insider and Business Insider:

Treasury yields sink to lowest level since April as revived COVID fears boost safe havens